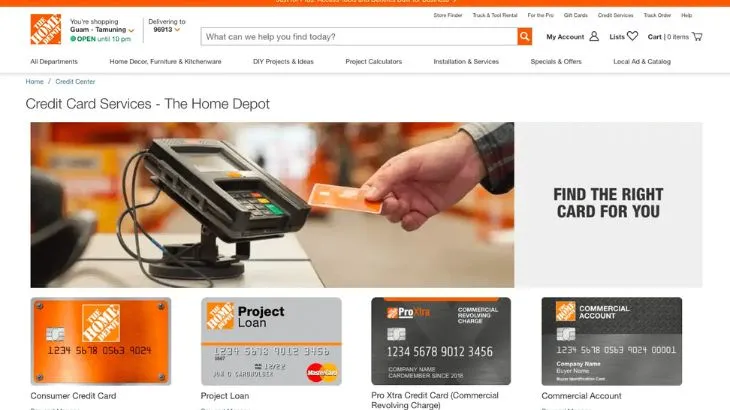

The Home Depot Consumer Credit Card may appeal to loyal shoppers looking to finance home improvement projects, but it lacks many of the perks that other credit cards offer. Before applying, here are five key details you should consider:

1. Special Financing with Deferred Interest

The Home Depot Consumer Credit Card offers deferred interest on purchases of $299 or more, which can help you finance large home projects. However, deferred interest is not the same as a 0% introductory APR. If you don’t pay off the balance in full before the promotional period ends, you’ll be charged interest retroactively from the date of purchase, which could lead to significant costs. For those seeking a true 0% offer, cards like the BankAmericard® credit card may be a better option.

2. High Interest Rate on Carried Balances

Carrying a balance on this card is costly, as the ongoing APR is 29.99%, variable. Even if you don’t use the deferred interest feature, you should avoid carrying a balance, as the high interest rate can lead to large interest payments over time.

3. Longer Return Period and Exclusive Offers

One of the notable benefits of the Home Depot Consumer Credit Card is the extended return period. Cardholders get up to one year for hassle-free returns on Home Depot purchases, which is four times longer than the standard return policy. Additionally, exclusive promotions, like up to 24-month financing, are occasionally available.

4. Separate Card for Larger Projects

For bigger home renovations, Home Depot offers the Project Loan Card, which allows customers to borrow up to $55,000. Interest rates can be as low as 7.42%, but terms will vary. This option could be useful for large-scale projects like kitchen or bathroom remodels.

5. Lack of Rewards or Discounts

Unlike other store-branded credit cards, the Home Depot Consumer Credit Card doesn’t offer ongoing rewards or discounts. If you’re not committed to Home Depot, other options like the Lowe’s Advantage Card, which offers 5% off eligible purchases or deferred interest, may provide better value.

The Home Depot Consumer Credit Card can be useful for financing big purchases, it lacks rewards and comes with high interest rates. Shoppers may find more value in a traditional cash-back or low-APR card for their home improvement needs.