The U.S. federal income tax brackets for the 2025 tax year have been officially released, bringing important changes for married couples filing jointly. These adjustments are based on inflation, which affects the income thresholds for each tax rate. While the tax rates themselves remain the same, the brackets have been expanded to reflect the economic shifts, helping many taxpayers avoid “bracket creep” as inflation continues to impact earnings.

2025 Federal Tax Brackets for Married Filing Jointly

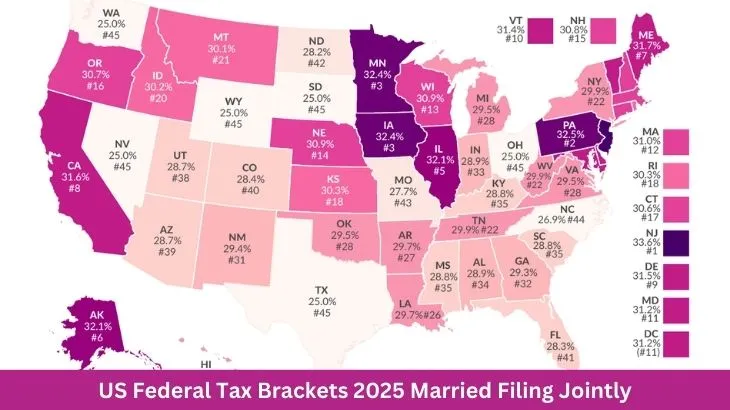

The updated tax brackets for married couples filing jointly are as follows:

- 10%: Income up to $23,850

- 12%: Income between $23,850 and $96,950

- 22%: Income between $96,950 and $206,700

- 24%: Income between $206,700 and $394,600

- 32%: Income between $394,600 and $501,050

- 35%: Income between $501,050 and $751,600

- 37%: Income over $751,600

These are the income thresholds where each corresponding tax rate will apply. It’s crucial to remember that these rates are marginal, meaning they apply only to the income within each range, not to your entire taxable income. For example, if a couple earns $100,000 in taxable income, their income will be taxed at various rates across different portions of that total, not just one flat rate.

How Inflation Affects the 2025 Tax Brackets

The tax brackets for 2025 are broader than those in previous years, reflecting an inflation adjustment designed to prevent taxpayers from being pushed into higher tax brackets due to inflationary wage increases. This is an effort to mitigate what is often referred to as “bracket creep,” where wages rise due to inflation but income taxes increase as well, despite the purchasing power of the wage not improving.

For instance, in the 2025 tax year, the threshold for the 24% bracket for married couples filing jointly is now set at $394,600, up from $364,200 in 2024. This expansion of the brackets offers relief for many taxpayers whose income increases in line with inflation but who would otherwise face a higher tax rate without these adjustments.

Standard Deduction Increase for 2025

Along with the tax bracket adjustments, the standard deduction for married couples filing jointly has increased to $31,800 for 2025. This increase helps reduce the amount of taxable income, lowering the overall tax burden for many households. The standard deduction is a significant factor in how much income is taxable, and the adjustment for inflation means taxpayers will be able to shield more of their income from federal taxes.

Planning for 2025

With these updated tax brackets, married couples filing jointly can take advantage of wider tax ranges, potentially keeping more of their income in lower tax brackets. However, individuals should still carefully plan their tax strategy to make sure they are minimizing their liability by considering deductions, credits, and other tax-saving strategies available to them.

Financial advisors recommend that taxpayers review their withholding and estimated tax payments for 2025 to ensure that they are on track to meet their tax obligations without underpaying or overpaying throughout the year.

The new 2025 federal tax brackets for married couples filing jointly offer a mix of relief and adjustment, with wider ranges designed to prevent inflation-related tax increases. As these changes unfold, it is important for taxpayers to stay informed and plan accordingly. By understanding the impact of the updated brackets and standard deduction, married couples can optimize their tax situation and keep more of their hard-earned money.

For more details, visit the IRS official website or trusted financial news outlets.